If buying a home isn’t right for you, you might want to consider building one instead. Building your own home is exciting, but it can often feel overwhelming. Knowing what to expect can help your build process go more smoothly – so you can stay cool, calm and collected.

That’s why we’ve put together these tips for building a house. From deciding how to build the home to your home loan and final inspection, our tips can help you successfully navigate the construction process.

Here’s what to know before building a house:

1. Choose The Right Building Method For You

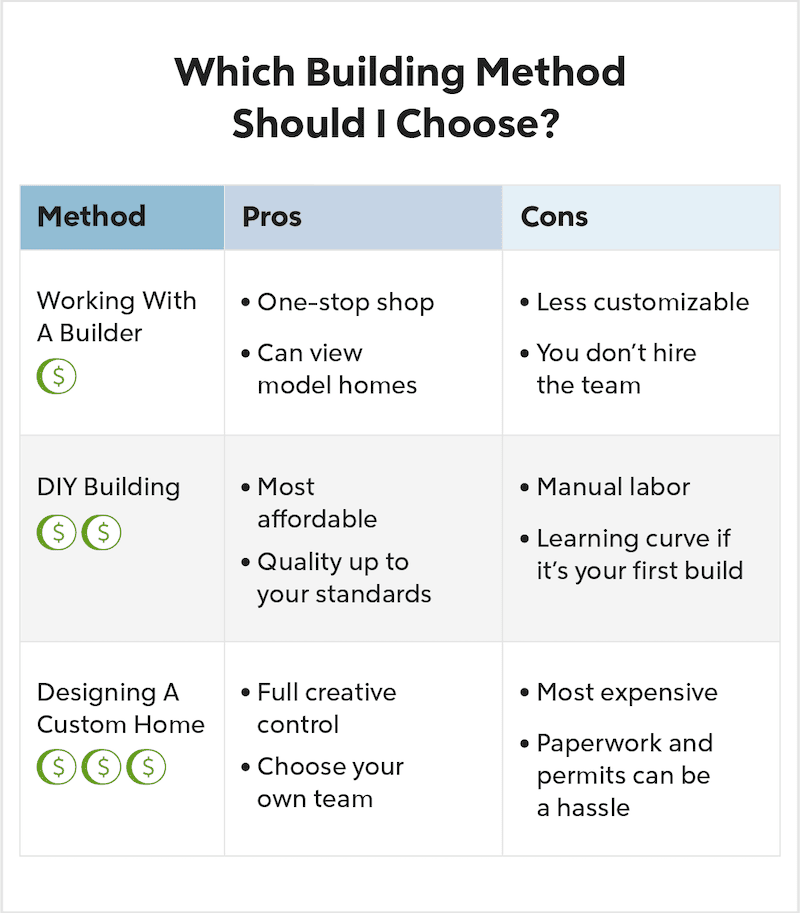

When building a home instead of buying a home, the first thing to do is decide which building method will work for you. In general, there are three paths you can take.

Work With A Builder

Working with a builder is a one-stop shop. Building companies typically buy parcels of land, hire all necessary labor and offer predesigned home layouts for buyers to choose from.

Working with a builder is a great option if you don’t want to invest time and effort into gathering all the necessary paperwork and hiring team members yourself. Builders usually have model homes to display. You can see what your home will look like before you invest in its construction.

The downside of working with a builder is that you have less control over the home’s design aspects. Sometimes builders have a limited set of options to choose from for paint colors, cabinets or other features.

Budgeting tip: When working with a builder, be mindful that the list price of the model home is usually a base price that doesn’t include any upgrades. Plan to pay more if you want different flooring, countertops or other upgrades.

Design A Custom Home With A Contractor

If you want total control over your home build, consider designing a custom home with a contractor. If you take this route, you’ll need to assemble your team, purchase the land, gather the necessary permits and oversee all other aspects of the project, including choosing your floor plan. It’s more involved than working with a builder and can be more expensive, but you’ll have complete creative control.

Budgeting tip: If you don’t mind surrendering control over the floor plan, you can save money by buying pre-drawn plans rather than customizing the home’s layout with an architect. Custom floor plans typically run about 5% – 10% of the cost of the home and take weeks or months to deliver. Pre-drawn plans can save time and money because of their fast delivery time and affordability.

DIY Building With No Contractor

If you have construction experience, you’ll probably save the most money by applying some sweat equity and building the home yourself. Just be sure you have the appropriate permits and your build is up to code. If you’re unsure about an aspect of building, you can always hire help where it’s needed – like with plumbing or electrical.

Budgeting tip: If your construction experience is thin, it may be worth hiring a professional to help avoid costly mistakes – like an incorrectly laid foundation or a leaky roof. But if your primary goal is to save money, there are other more affordable ways to build a home.

See What You Qualify For

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

2. Buy The Right Plot Of Land

Once you know how you’ll be building your home, it’s time to consider land. If you aren’t working with a builder, you’ll need to find land yourself or with the help of an agent. Because there are several factors to take into account as you search for the right land plot, it’s usually a good idea to work with a real estate agent experienced in land purchases.

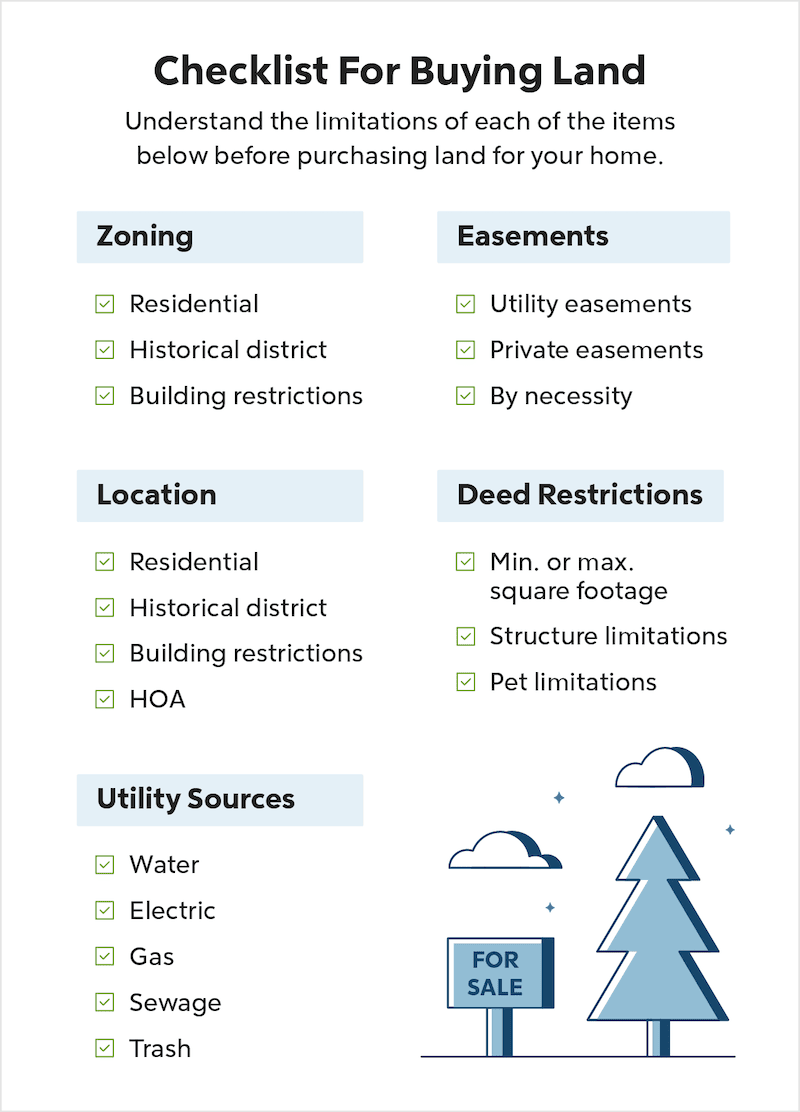

When choosing land, be sure to consider:

- Zoning: Is the land zoned for residential use? Is it in a historical district that may impact building requirements?

- Location: Are there any commercial, historical or homeowners association (HOA) issues related to the plot of land? Is the land in a flood zone? Some plots may look perfect when dry but can become hugely problematic when flooded.

- Deed restrictions: Land deeds sometimes have special restrictions – like minimum or maximum square footage for dwellings or structure or pet limitations. Your real estate agent should get you this information.

- Easements: If you don’t check your land for easements before buying, you may run into surprises. Easements give people or entities, like utility companies or the local government, the right to access property they don’t own for specific purposes. That means your neighbor may have the right to cross your property to reach their own, interrupting your privacy.

- Utility sources: Check if the lot is serviced by local trash services. And check with the water and utility companies that would be servicing your land to gauge costs. It can be expensive to hook up to utilities in remote locations.

Budgeting tip: Survey the entire plot of land before purchasing it to help ensure you won’t run into unforeseen costs. For example, during your walk around, you may find a structure on the land you didn’t know about. Removing unwanted structures can be costly, but you may be able to negotiate removal costs with the seller if you know about it beforehand.

3. Check For Any HOA Restrictions

One of many things to consider when building a house is whether it will be governed by a homeowners association (HOA). Even homes in rural areas can be managed by HOAs. If there is an HOA associated with the property, request a copy of the association’s covenants, conditions and restrictions (CC&Rs), which cover any rights, rules and restrictions on the property. Some HOAs may regulate minimum or maximum square footage requirements, exterior paint options, landscaping or other home design features.

Budgeting tip: Failing to comply with HOA regulations can lead to costly fines. It’s always best to check the guidelines before you do anything to the land or property.

4. Obtain The Necessary Permits

The types of permits you’ll need will vary by location. Different municipalities will have different rules. It’s best to check with your local building department before beginning your project to get an idea of the permits you’ll need.

Depending on the work you’re doing and where you’re buying the land, you may need the following permits:

- Demolition permit

- General building permit

- Electrical permit

- Plumbing permit

- Mechanical permit

- Solar panel permit

Budgeting tip: Permit fees will vary depending on the type of permit and where you live. And you may get discounts by purchasing multiple permits at once.

5. Hire The Right Team

If you aren’t working with a builder, you’ll likely need to hire some team members or an entire building team, which can include:

- Contractors

- Architects

- Designers

- Plumbers

- Electricians

- Inspectors

And even if you decide to work with a builder, you’ll still need to do your research to find the right company. According to the National Association of Home Builders, you can find potential builders by:

- Contacting your local home builders association for a list of builders in your area.

- Searching the real estate section of the local newspaper for builders and projects. Your research can help you learn which builders are active in your area and which ones are building homes you like in your target price range.

- Asking local real estate agents, friends and relatives.

Also, try talking to homeowners who have had homes built by the companies you’re considering.

Ask plenty of questions. And don’t ever think any question is too insignificant to ask. Ask about warranties, average completion timelines for past projects, licensing, business experience, etc. Take your time and be thorough when selecting the team that constructs your dream home.

Budgeting tip: If you’re worried about builders or other team members going over budget, you may be able to put a cap on expenses in your contract.

6. Have A Flexible Timeline

A flexible timeline is one of the most important things to have when building a house. Shipping delays, supply shortages, weather conditions or other unexpected challenges can all push back your expected move-in date.

It’s a good idea to have a backup plan in case of delays. You may need to scope out month-to-month rental options or identify family members to stay with.

While your build may be delayed, the payment due dates on your bills won’t be. Consider whether you’ll be able to afford property taxes or HOA dues while your home remains under construction. If you’re not sure what your property taxes will be, you can estimate them based on your state’s property tax rate.

Budgeting tip: Your mortgage rate may increase if your closing is delayed. You can lock in your rate to prevent an increase. And negotiate “what ifs” with your lender or builder before they happen.

Take the first step towards buying a house.

Get started today to see what you qualify for.

7. Know Your Budget

Your budget for building a house will vary depending on many factors, from the builder’s fee to the layout, the labor involved and the cost of materials. For example, a house built on a slope may be more challenging and expensive to build than a house on level ground.

Building a square or rectangular house with a few odd angles and curves will be less pricey than a complicated custom layout featuring twists, turns and turrets.

If you plan on financing your new home with a construction loan, talk to a lender and get preapproved. Once you know how much you can borrow, you can build a budget that accommodates the following considerations:

- Your priorities: What is most important to you? Is it a professional-grade kitchen? Multiple bedrooms? A home office? Make a list of your must-haves and calculate the potential cost.

- Your trade-offs: Maybe you want an all-marble kitchen island, but it has a heftier price tag than you bargained for. What would you be willing to cross off your must-haves list? Will it be the fancy kitchen or the library you wanted? Take another look at your priorities to help finalize the essentials.

- A cost-benefit analysis: Figure out what is and isn’t worth the cost. When you’re ready to sell your home, will the pool be worth the cost of installation? Are you going to get a significant return on investment for certain features in your home?

Don’t forget to factor in outdoor features you plan on adding as you create your budget. Unless you’re going for that “fresh from the construction lot” dirt-and-rubble look, you should add a line in your budget for landscaping.

Budgeting tip: Several basic construction choices can significantly impact the cost of your new home. Choosing a two-story home over a ranch-style home will generally cost less because you’ll use less material per square foot. For foundations, concrete slabs are the cheapest, and basement foundations are the most expensive.

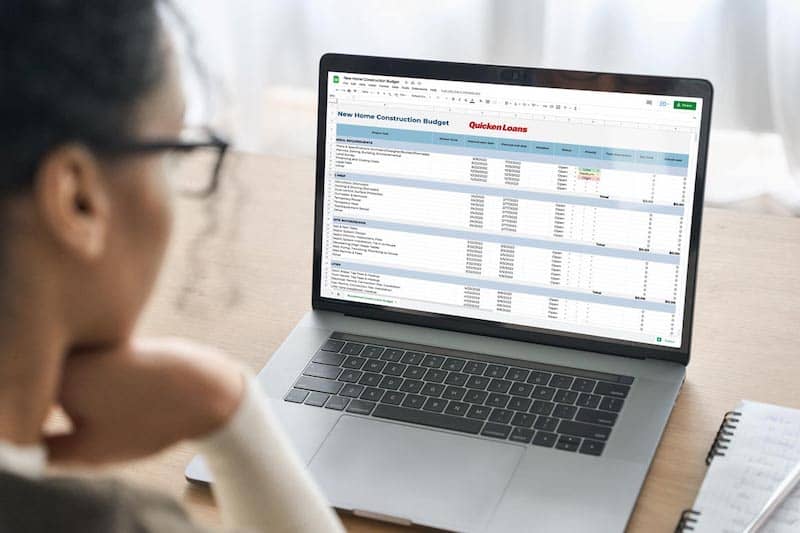

Create A Budget Spreadsheet

You can create a budget spreadsheet to track every aspect of your home build, including:

- General requirements

- Site prep

- On-site/water/sewer requirements and testing

- Utilities

- Excavation and earthwork

- Foundation

- Masonry and paving

- Framing

- Exterior

- Windows/exterior doors

- Plumbing

- Electrical

- HVAC

- Insulation and air-sealing

- Drywall/plaster

- Interior finishes

- Kitchen and bath

- Porches and decks

- Appliances

Or you can save some valuable time and use our comprehensive budgeting spreadsheet.

8. Consider Going Green

Consider making your new home a “green” home. While ENERGY STAR® homes are better for the environment, meeting energy-efficiency requirements can cost about 4% – 8% more upfront compared to a home that isn’t energy-efficient.

However, an energy-efficient home offers many benefits, including improved air quality, better comfort and temperature control, and most of all, reduced energy bills.

Although the initial cost is higher, it will likely pay for itself over time and may even bump up your asking price when you’re ready to sell your home.

Budgeting tip: Start small if your budget doesn’t allow you to purchase all the green features you’d like in your home. With ENERGY STAR® light bulbs, you can reduce your energy usage by 70% – 90%, and they’ll cost less in the long run because they outlast standard bulbs.

9. Be On The Lookout For Cut Corners

Sometimes, builders may miss a few things in their rush to meet deadlines and stay on schedule. To ensure the home meets the standard of quality you have in mind, you’ll need to stay involved throughout the building process. Keep an eye out for potential problems and commonly cut corners, such as:

- Cracks in sheetrock

- Unblended patches on walls

- Leaky faucets

- Sticky drawers

- Wrong materials (Did you choose granite for your countertop but got laminate instead?)

You shouldn’t need to worry about large structural issues because many home inspections will be completed on the home. The city wants to make sure your home is up to code as much as you do.

Budgeting tip: Asking for improvements during the build may help you avoid paying for fixes out of pocket after the builder leaves.

10. Keep Your Head Held High

Building your home can put you on a roller coaster of emotions. You may face decision fatigue or frustration if construction isn’t going according to plan. When problems pop up, try to take a step back and remember what’s important. Maybe your heart was set on oak cabinets, but you had to settle for cherry because of supply issues. It wasn’t your first choice, but maybe you can learn to live with it.

Try to see the forest through the trees. When you start to feel overwhelmed, manage your stress by reminding yourself what all the work is all about: creating a place to call home.

The Bottom Line: Have Patience and Be Flexible

Whether you’re doing it yourself or working with a contractor, building a home is an exciting endeavor. But it’s also an extensive process that requires a lot of patience and coordination. Take advantage of these tips so you’re better prepared to handle the inevitable ups – and downs – of building a home. Your goal should be to make your path to your dream home as stress-free as possible.

Building a home isn’t for everyone, and it’s not the only path to homeownership. If you want to purchase a new house sooner rather than later, purchasing an already-constructed home is probably the way to go.

Find A Mortgage Today and Lock In Your Rate!

Get matched with a lender that will work for your financial situation.

Victoria Araj

Victoria Araj is a Staff Writer for Rocket Companies who has held roles in mortgage banking, public relations and more in her 15-plus years of experience. She has a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan.