It’s essential to understand the fine print when signing any type of loan document, especially when you’re buying a home. However, when some borrowers look at these documents, they might glance over them instead of reading carefully. But this can cause an issue if the mortgage includes an acceleration clause.

Let’s dive into the details of how an acceleration clause works and what you can do if one is enforced on you.

What Is An Acceleration Clause?

An acceleration clause is a term sometimes included in a mortgage contract that gives the lender authority to request the full repayment of a borrower’s remaining loan amount. Normally, an acceleration clause can be triggered in specific situations, such as a breach of contract between the borrower and lender.

This legal provision gets its name because it accelerates the mortgage agreement so that the borrower must immediately pay off the loan principal with any interest that was accrued before the clause was triggered. Many lenders require the repayment in a lump sum to avoid charging additional interest payments afterwards.

Due-On-Sale Clause Vs. Acceleration Clause

When discussing acceleration clauses, you may also hear the term “due-on-sale” or “alienation” clause, but are these the same thing as an acceleration clause?

A due-on-sale clause (sometimes called an alienation clause) is invoked when a homeowner sells a home with a lien, at which point the homeowner is responsible for repaying the mortgage and interest in full to the lender before transferring the property’s title to a new owner. There are exceptions to this clause’s enforcement, including death, divorce and other mortgage situations.

An acceleration clause also invokes the borrower to repay their loan balance in full but as a penalty for violating the loan’s terms. This can include missed payments, bankruptcy, canceled homeowners insurance and more.

Refinance Calculator

Get loan options at today’s interest rates that show what your new monthly payment could be. Just answer a few simple questions.

See What You Qualify For

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

What Triggers An Acceleration Letter?

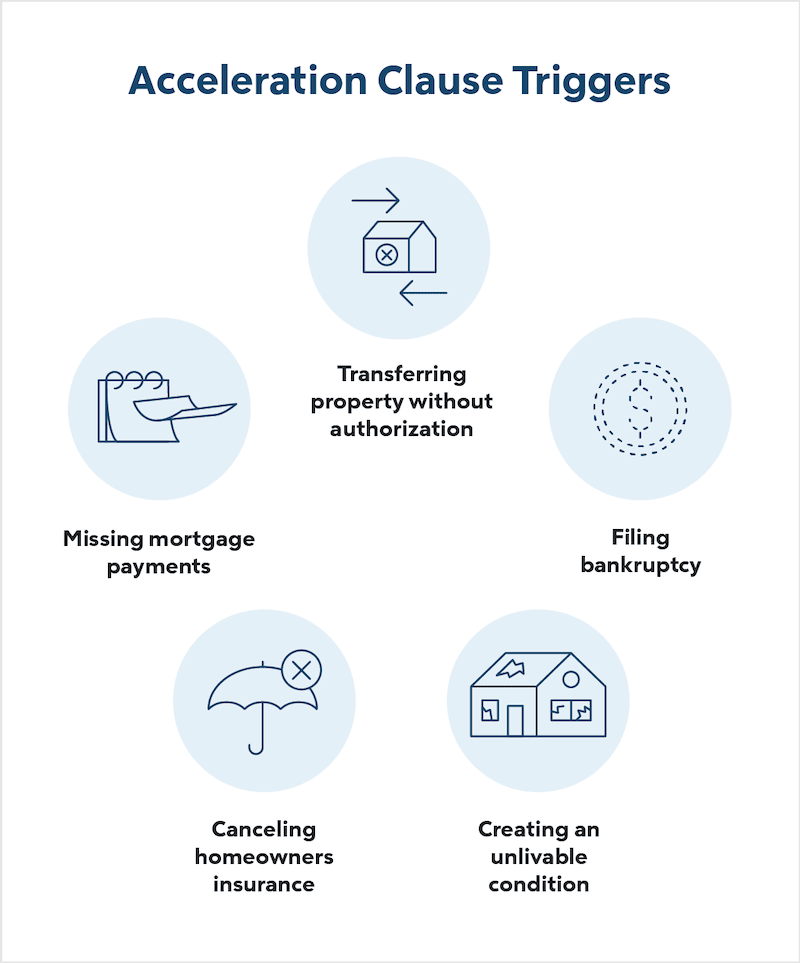

Certain conditions may breach the loan agreement and give lenders the right to impose accelerated repayments, including any of these situations:

- Missed mortgage payments: Laws and clauses vary, but lenders typically take action around the third missed payment.

- Bankruptcy filing: Bankruptcy may limit a lender’s ability to get their money back, so they may accelerate payments to protect themselves.

- Unauthorized property transfer: Lenders may enforce an acceleration clause if a property is transferred without their permission.

- Canceled homeowners insurance: Homeowners insurance is required for the full mortgage duration and canceling insurance may trigger the acceleration clause.

- Nonpayment of property taxes: Failing to pay property taxes could result in a lien against your home and trigger an acceleration clause.

- Creating an unlivable condition: Homeowners are responsible for maintaining their property, and an unlivable condition can result in acceleration.

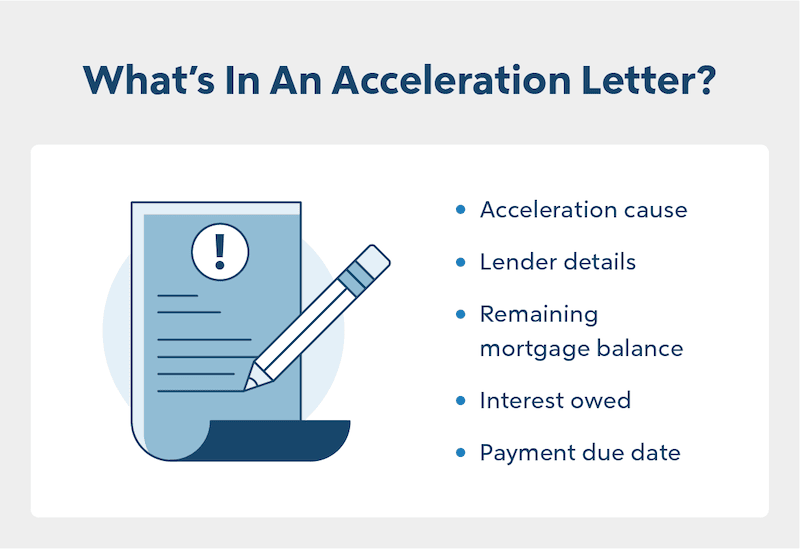

Usually, these acceleration clauses aren’t automatic. When you’ve done something to activate an acceleration clause, your lender will send a mortgage acceleration letter outlining the amount owed.

While each lender has their own timeline for late payments on a promissory note, most wait until the third missed payment to send out the letter. Lenders will also usually give borrowers a 30-day notice to repay the loan or come up with a financial plan. If the borrower is able to clear their default before the clause is invoked, the lender may lose their right to acceleration.

What Happens When Your Loan Is Accelerated?

There are generally five steps for a lender to accelerate a loan, and borrowers have a few options when handling the situation:

- The borrower defaults or creates another situation that meets the acceleration clause’s criteria.

- Most lenders will send a breach letter allowing the borrower to remedy the situation within at least 30 days before acceleration.

- If the default isn’t cleared, the lender can invoke accelerated payments by sending an acceleration letter.

- The borrower is required to pay the entire balance in full, agree to a short sale or home transfer, or enter the foreclosure process.

- The borrower may also have options to reinstate the loan after acceleration.

Can You Avoid Triggering An Acceleration Clause?

The easiest way to avoid accelerated payments is to maintain a good standing with your mortgage servicer. This includes making timely and complete payments, paying all homeownership costs like homeowners insurance and property taxes, and maintaining your property.

If you’re worried about affording your monthly payments, contact your servicer immediately to learn about their mortgage assistance options. You can also refinance to reduce your monthly costs and avoid falling behind.

How To Settle Your Accelerated Mortgage After A Missed Payment

Federal laws require that lenders wait 190 days after a missed payment to begin foreclosure, so homeowners do have a window of opportunity to catch up on late payments and fees. Once caught up, mortgage payments resume as normal.

But when money’s tight, it’s hard to catch up on a defaulted loan. Borrowers who can’t afford to repay past due amounts may have to consider these other options to maintain their mortgage or settle the situation with their lender.

1. Mortgage Acceleration Repayment Plans

One option is to request a mortgage reinstatement. It comes in the form of a quote and will go over exactly how much you need to pay to catch up on missed payments, plus any other fees.

Once you pay the requested amount, you’ll no longer be in default and can start making your regular payments. Some lenders are flexible and may even make a repayment plan available so you can catch up on defaulted payments without a large lump sum payment.

2. Refinancing Options

Homeowners may be able to refinance their loans for a lower monthly payment. Refinancing potentially allows a borrower to change their loan’s term and interest rate for more affordable payments.

3. Short Sale

Homeowners who owe more on their home than it is worth, and can no longer afford to make payments may consider a short sale, but lenders will only agree to this option under certain circumstances.

Typically, the property must have declined in value or the homeowner must be experiencing financial hardships that make repayment or selling the home impossible. Owners should also consider the impact a short sale can have on their credit score and financial future before choosing this route.

4. Home Foreclosure

Homeowners who can’t repay the default will enter the preforeclosure process, which is a period to take advantage of any of the above options to catch up on payments. If repayment still isn’t feasible, the property could be foreclosed on and sold to cover outstanding debt. But this is the last resort and represents a loss for everyone involved.

5. Additional Repayment Resources

Before you find an acceleration letter in your mailbox, you should contact your lender as soon as you’re struggling to make mortgage payments. Explaining your financial situation allows your lender to detail what mortgage assistance options they can offer to help you avoid foreclosure.

Housing counselors are also available to homeowners through the Department of Housing and Urban Development (HUD). They can provide budgeting assistance and financial advice based on your situation.

Below are additional resources to help with your loan repayment:

- Fannie Mae Loan Lookup: This option is for borrowers with a Fannie Mae-owned loan.

- Freddie Mac Loan Lookup: This option is designed for borrowers with a Freddie Mac-owned loan.

- VA Counseling: This is financial advice available for veterans and active service members to avoid foreclosure on VA loans.

There are federal and local resources available to assist struggling homeowners but stay cautious of foreclosure rescue scams that ask for fees upfront. If you’re not sure whether assistance is genuine, contact your lender or HUD.

Real Estate Acceleration Clause FAQs

Accelerating a mortgage isn’t anybody’s ideal situation, but financial hardships happen. Here are some additional insights that can help you avoid acceleration or better understand your loan’s expectations.

Are acceleration clauses in mortgages legal?

It depends on where you live. Acceleration clauses are very common and legal in repayment contracts. However, local regulations vary. It’s important to check with the real estate attorney who handled your closing to make sure this clause is abiding by your state’s laws.

How can I avoid triggering an acceleration clause?

The best way to avoid triggering acceleration is to stay on top of your mortgage loan payments. If you find yourself falling behind, you have options when it comes to avoiding an acceleration clause.

Work with your lender to figure out a loan modification or repayment plan to make the delinquent payments. Lenders want to avoid foreclosure, too, so many servicers have mortgage assistance programs. Federal counselors are also available for financial assistance.

Keep in mind that the borrower will be responsible for paying for the costs the lender incurred while working on the mortgage acceleration.

Do lenders have to disclose an acceleration clause?

According to the Supreme Court, no. The Truth In Lending Act (TILA), which regulates mortgage disclosures, doesn’t require a lender to disclose an acceleration clause.

What factors do lenders consider before enacting acceleration?

If you’ve spoken with your lender about your financial situation and sought assistance, they may be more lenient with your repayment and avoid invoking acceleration for an extended time. However, if any of the situations below occur, your lender may have the right to request accelerated payments:

- Multiple missing mortgage payments

- Bankruptcy filing

- Unauthorized property transfer

- Canceled homeowners insurance

- An unlivable property condition

What’s the difference between alienation and acceleration clauses?

Both alienation and acceleration clauses are common additions to real estate contracts that allow a lender to demand full repayment of the debt. However, alienation clauses pertain to the sale of a property, while acceleration clauses affect homeowners who violate their contract agreements.

The Bottom Line: Prioritize Your Payments To Avoid Mortgage Acceleration

One way to ensure that you don’t end up in a situation where an acceleration clause could be enforced is to refinance before you go into default. While there are several financial benefits, many homeowners find that refinancing can help lower their interest rate or extend their term, making it easier to afford their payments.

If you’re looking at your budget and have decided that refinancing is the right option for you, get started today to see your options so you can make the best financial decision.

Ready to refinance?

See recommended refinance options and customize them to fit your budget.

Victoria Araj

Victoria Araj is a Staff Writer for Rocket Companies who has held roles in mortgage banking, public relations and more in her 15-plus years of experience. She has a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan.