After weeks of scrolling through listings and touring homes, you finally find a home you want to make an offer on. But how much should you offer on a house? The answer depends on many factors, including your home buying budget, the local real estate market, how long the home’s been for sale, and its condition. Here are steps to put all those factors in perspective and make an offer the seller will accept.

Key Takeaways:

- Determining how much to offer on a home is the most important part of buying a house, but it can also be the most difficult.

- Consider factors such as the strength of the market, the property’s condition, and how long it has been on the market.

- In some cases, you may offer more or less than the asking price or find other ways to strengthen your offer.

7 Factors To Consider Before Making An Offer On A Home

Do you want to make sure your offer is accurate and reasonable but aren’t sure where to start? It’s a good idea to discuss it with your real estate agent, who should have enough experience to help you make a solid offer on a home. In addition, consider the following questions to help you make your best offer.

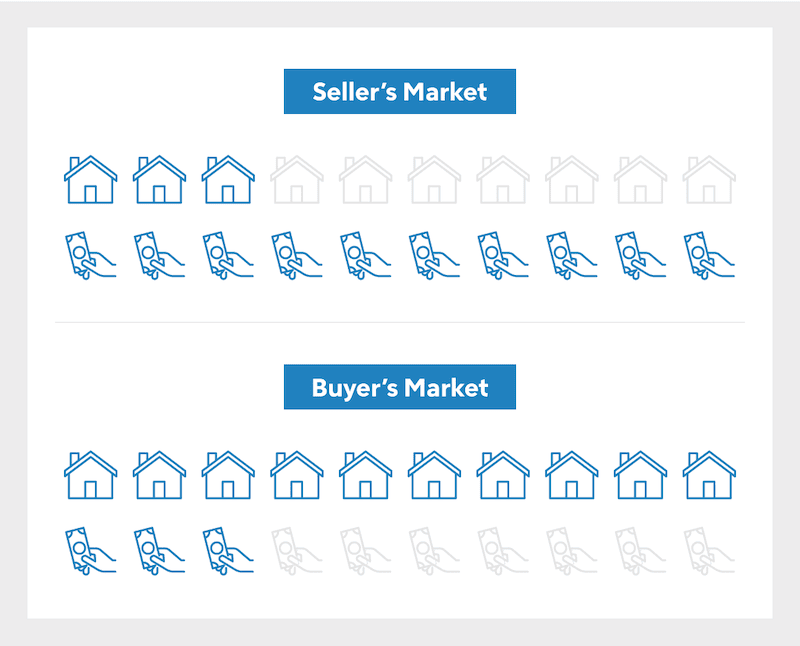

1. Is It A Seller’s Or Buyer’s Market?

When thinking about how much should I offer on a house, the first thing to consider is local market conditions.

In a seller’s market, buyers outnumber available homes. This may spark bidding wars, driving up prices.

A buyer’s market has more homes than buyers. Sellers are more likely to accept offers below the listing price and contingent offers are more common.

A balanced market is when there is an equal number of buyers and houses for sale. You’ll rely more heavily on your real estate agent’s expertise and experience in negotiating offers.

2. How Long Has The Listing Been Active?

The date a home was listed for sale usually is in the listing. If not, you can ask your real estate agent to pull this information.

If a property’s been on the market for several months and the asking price has been reduced, the seller may be anxious to sell. You may be able to negotiate the asking price and buy the home for a reduced price.

If a property has been on the market only for a few days, it’s best to match the asking price and be prepared for a bidding war if the home draws a lot of interest.

3. What Is The Condition Of The Property?

You’ll find that move-in-ready homes – sometimes called turnkey homes – are more expensive than homes needing repairs.

Are you looking for a home to remodel and make your own, or are you looking for a move-in-ready home? Include a home inspection contingency in your offer to get a third-party report on the home’s condition before closing. This allows you to negotiate repairs or the price if problems are found.

4. How Much Can You Afford?

You’ll need to make an offer you can afford. Mortgage preapproval will estimate how much your lender will let you borrow. This will give you a ballpark number to keep in mind as you search for a home.

In addition to the monthly mortgage payment, make sure you understand the ongoing costs of buying a home, including homeowners insurance, property taxes, homeowners association fees, maintenance, utilities and repairs.

5. How Does The Listing Price Compare To The Local Market?

Once you have a budget, research recent sales in the area you’re looking to buy. When you find a home you want to buy, compare the asking price to comparable homes that sold recently.

Ask your real estate agent for a comparative market analysis showing recent sales prices for local homes. This will help you gauge whether the seller’s asking price is fair and reasonable or if they’re asking too much or too little for their home.

6. What Does Your Agent Think?

An experienced real estate agent knows the local home market well and will have a good sense of a property’s fair market value, how hot the market is, and what constitutes a reasonable offer. You’re paying your agent for their help and expertise, so ask their opinion.

7. How Much Do You Want This Property?

If you’ve settled on a reasonable asking price you can afford, ask yourself how well this home fits your needs. Do you need to make alterations? If so, how much will they cost? Is the asking price within your budget? Will this property meet my needs? The answers will tell you whether to make an offer and for how much.

What’s Your Goal?

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

Making A Reasonable Offer

Sometimes, offering more than the asking price is necessary, and there are situations when offering less will work. It all depends on the market in your area and the property itself.

When To Offer More Than Asking Price

If it’s a seller’s market and there’s lots of competition for a home, offering more than the asking price could give you the upper hand and seal the deal.

How much more to offer depends on the listing and the local market. Your real estate agent should know what other similar properties are being sold for. Take this into consideration when determining how high you’re willing to go while staying within your budget.

Make sure you’re comfortable with your offer. You don’t want to make an offer on a home you’re unable to afford.

Most appropriate situation: When there’s a lot of competition for a home in a seller’s market

How Much More Should I Offer?

If you’re thinking about offering more than the asking price, how high you want to go will depend on the situation.

- Less than 10% over: If you’re in a relatively neutral market, you may want to offer just a bit more than the asking price to show your interest in a home and to make your offer more competitive.

- 10% over or more: If you’re in a seller’s market, you may need to go even higher with your offer. Your agent should be able to pull data on recent listings and sale prices to give you an idea of how much more you should offer.

When To Offer Less Than Asking Price

Sometimes, the seller accepts an offer for less than the asking price. This usually occurs in a buyer’s market, especially when a property has been on the market for a long time.

When making an offer for less than the asking price, be ready for some resistance. Also, take care not to offer so little that you insult the seller. If you really want a home, you want the seller to at least be willing to negotiate with you rather than reject the offer outright.

How Low Can You Go?

How much below asking price should I offer on a house? If you’re considering an offer for less than the asking price, deciding how low to go can be difficult. Ask your real estate agent, but also consider the following rules of thumb for making an offer on a house.

- Less than 10% below: This is a reasonable offer if the property requires only cosmetic repairs. If the home is move-in-ready, make an offer closer to the asking price. This will decrease the chances of receiving a counteroffer.

- 10% to 20% below: This price range may be suitable if the house is outdated and requires renovations. For example, if the home needs new flooring and appliances, an offer in this range will help you cover those costs.

- 20% below: This is considered a lowball offer and is best if the property requires extensive renovations and upgrades to make it livable. This would be suitable if the home needs significant fixes to the plumbing, upgrades to the electrical wiring, or has extreme water damage.

Most appropriate situation: When there’s no competition for a property in a buyer’s market.

Ready To Become A Homeowner?

Get matched with a lender that can help you find the right mortgage.

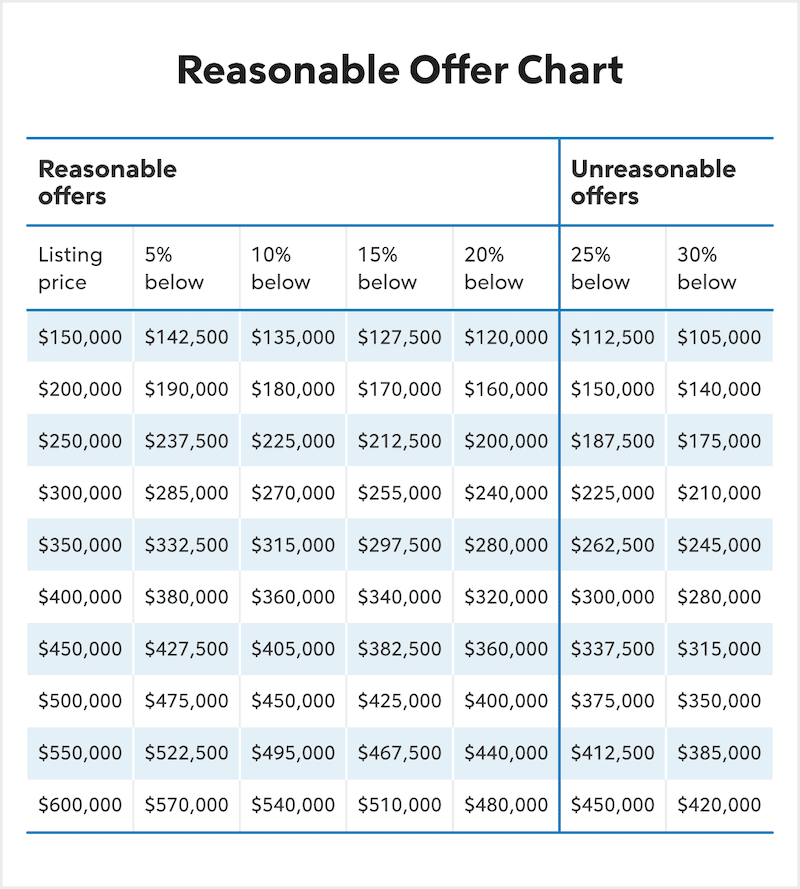

Reasonable Offer Chart

Ready to crunch the numbers for the best offer? Trying to figure how much do sellers usually come down on a house? Use this reasonable offer chart to help you determine how much to offer.

Using an Escalation Clause

Another way to strengthen your offer is with an escalation clause, which increases your offer to beat competing bids to a maximum.

For example, you might submit an offer to buy a home for $500,000 with an escalation clause that increases your bid in $1,000 increments to a maximum of $550,000. If no one offers more than $500,000, you can buy the property for $500,000. If someone offers $510,000, your bid would automatically go up to $511,000. If someone offers more than $550,000, you’re losing out on the home but won’t have paid more than you can afford.

A drawback of escalation clauses is that they show the seller the maximum you’re willing to pay, which limits your negotiating strength. Things also can get murky if you ask the seller for proof of a higher offer to activate the clause. The seller may fabricate a fake offer to get more money from you or be unwilling to show you other offers from other buyers.

Take The First Step To Buying A Home

Find a lender that will work with your unique financial situation.

Other Ways to Strengthen Your Offer

The offer price is likely the most substantial piece of your bid, but there are other things you can do to sweeten the deal for the seller.

Offer More Earnest Money

Earnest money is cash you pay the seller when making an offer to show you’re serious about buying the home. If the seller accepts your offer and the earnest money, it’s applied to your down payment or closing costs when finalizing the sale. But if you withdraw from the sale for a reason not covered by contingencies in your purchase and sale agreement, the buyer keeps the earnest money as compensation for their time and effort. Earnest money protects the seller if you can’t close the deal, and a bid with a generous earnest money deposit may be more attractive to them.

Be Flexible On The Closing Date

If you don’t need to move in right away, offering the seller flexibility on when to close can strengthen your offer. A later closing gives the seller more time to find a new home, more time to pack, and more time to move, reducing the stress they may feel when selling their home.

Make A Cash Offer

Making a cash offer to buy a home means you’re not offering to buy the property contingent on your ability to get a mortgage. That offers two significant benefits to the seller.

One is that they don’t have to worry about you failing to get a mortgage, giving them more confidence that the sale will go through.

The other is that applying for a mortgage and getting it approved takes time. The lender will do its due diligence, order home appraisals and verify the buyer’s credit score and finances. Skipping that process means the sale can close more quickly, which may appeal to the seller.

Consider Waiving Contingencies

Most offers include contingencies, which allow the buyer to cancel the sale if specific milestones aren’t met. For example, an inspection contingency allows the seller to cancel the sale if the inspection finds the home needing expensive repairs.

Waiving contingencies reduces your ability to cancel the deal, which may reassure the seller you won’t back out over a minor obstacle. The downside is you’re taking a risk when waiving contingencies that you may buy a home that requires you to pay for significant repairs.

FAQ

Here are answers to common questions about how much to offer on a house.

The Bottom Line

Deciding how much to offer on a house is a significant decision. Offer too much, and you may overpay. Offer too little, and you may be outbid by another offer. To decide on a reasonable offer, consider the state of the market, the condition of the home, and how long it’s been for sale. Don’t be afraid to ask your agent for their opinion, as it can make all the difference to making a successful bid.

T.J. Porter contributed to the reporting of this article.

T.J. Porter

T.J. Porter is a Boston-based writer who focuses on credit cards, credit and bank accounts. When he's not writing about all things personal finance, he enjoys cooking, esports, soccer, hockey, and games of the video and board varieties.