When you’re buying a house, a signed deed transfers ownership of a property to you. There are several different types of deeds that are used in real estate, including general warranty deeds, quitclaim deeds for property transfer between friends and relatives, bargain and sale deeds, and special warranty deeds.

A special warranty deed in real estate offers protection to the buyer through the seller’s guarantee that the title has been free and clear of encumbrances during their ownership of the property. It does not guarantee clear title beyond their ownership.

Most home buyers don’t need a special warranty deed, but if it comes up in your home search, here’s what you need to know.

Key Takeaways:

- Special warranty deeds are common for commercial property, estates or foreclosures.

- These deeds guarantee a title is clear and free from the seller’s ownership period and excludes claims resulting from prior owners.

- These deeds are best for sellers, while general warranty deeds offer more protections for buyers.

Table Of Contents:

See What You Qualify For

Buy A Home

Discover mortgage options that fit your unique financial needs.

Refinance

Refinance your mortgage to have more money for what matters.

Tap Into Equity

Use your home’s equity and unlock cash to achieve your goals.

Understanding Special Warranty Deeds

This deed offers a level of protection to the buyer (aka grantee) in that the seller (grantor) warrants that there are no problems with the property that arose during the seller’s time of ownership. The seller isn’t liable for any liens or claims against the property that may have occurred before they purchased it, and the grantee assumes all responsibility to issues created by other previous owners.

Special warranty deeds are common in commercial real estate purchases or in cases where the current owner may not know the property’s complete history, like grantors selling an inherited property. A typical single-family home purchase doesn’t use special warranty deeds.

These deeds also have a number of different names, including:

- Covenant deed

- Grant deed

- Limited warranty deed

What Do They Include?

In addition to the basic property and ownership details required in all deeds, a special warranty deed should assert:

- The grantor’s legal ownership and transfer rights

- That there weren’t any claims against the property during the grantor’s ownership

- The grantor’s guarantee of a clear title during their ownership and a relinquishing of any responsibility for issues prior to the grantor’s ownership

This protects the seller against any unknown claims prior to their ownership and places responsibility for potential claims on the buyer. The deed will also include general property details, such as:

- Grantor’s name and address

- Grantee’s name and address

- Legal property description

- Transfer statements between grantor and grantee

When Are They Used?

There are three main types of transactions in which special warranty deeds may be used. We’ll go over them and give explanations of examples when they apply.

- Estate transactions: In an estate transaction where the person responsible for administering the estate has nothing attesting to the history of the property prior to the owner who has passed, a special warranty deed may be issued.

Example: If John Doe passed on and all the executor knew was that John didn’t have any liens on his property personally, the special warranty would cover the fact that the seller didn’t have any title issues, but not warrant against everything that happened with the property in the past.

- Commercial property transactions: Special warranty deeds are typical in business property sales between companies. A business is usually aware of any title issues that may have existed when they owned the building, but that knowledge doesn’t always extend to previous ownership.

Example: Apple selling a building to Microsoft is a business transaction that would necessitate a special warranty deed.

- Foreclosure: If properties are foreclosed upon for any reason, the authorities or investors selling those properties will generally only warrant that no new claims or liens have been made against the property since they took possession. It’s important to be particularly careful when you’re buying a foreclosure because you might have to do things like pay back taxes in order to remove the existing liens from the property.

Example: If an owner forecloses on their property because they can’t afford mortgage payments, they may have other financial obligations that placed a lien against the home. A special warranty deed places responsibility for these liens on the new owner, not the investor selling the property.

Find A Mortgage Today and Lock In Your Rate!

Get matched with a lender that will work for your financial situation.

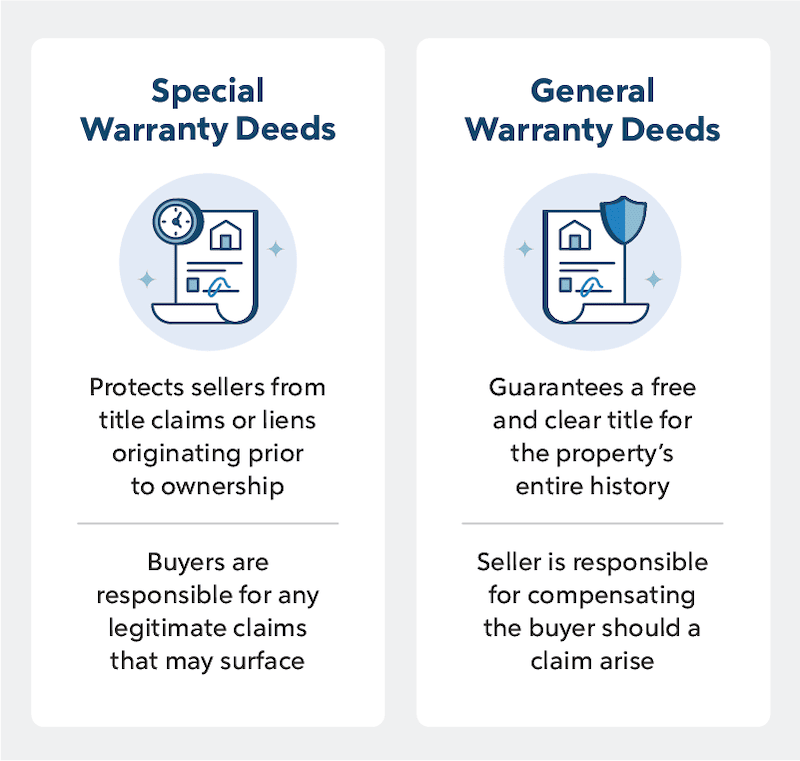

Special Warranty Deeds Vs. General Warranty Deeds

A general warranty deed guarantees that a title is free and clear of any liens or claims against the property throughout its history, and assumes responsibility for any claims or liens that may appear from past owners.

From a buyer’s perspective, the best thing a seller can do is give you a general warranty deed. The seller is guaranteeing that there are absolutely no problems with the title, whether they occurred during or prior to their ownership.

A special warranty deed only serves as a guarantee that there are no problems with the title outstanding from when the current seller owned the property. It’s possible with this type of deed that someone else could come along who had a claim to the property or a lien existing from some long-unpaid debt. If the property right was legitimate, you could be forced to leave the home.

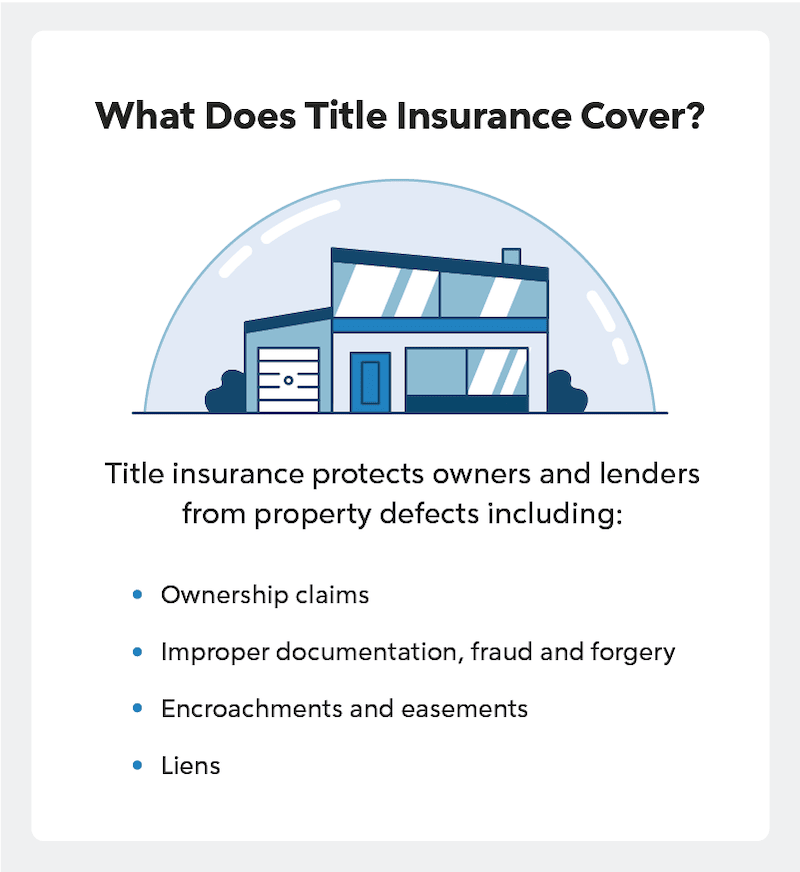

One way to fully protect yourself against any liens or claims on the property that may come back to haunt you in the future is to get title insurance. If you’re buying a home with a mortgage, your lender will require you to get a lender’s title policy, which pays off the mortgage in case title trouble comes up in the future. If you’re buying a home with a special warranty deed, you’ll also want to strongly consider getting an owner’s title policy.

Pros And Cons Of Special Warranty Deeds

The benefits and considerations of a special warranty deed vary between homeowners and sellers. Generally, this deed offers the most benefits to home sellers, but here’s an overview of considerations for both parties:

Pros:

- Protects sellers from financial responsibility if someone unknown has a genuine claim for the property.

- Helps speed up and smooth the process of buying a property in foreclosure.

Cons:

- Fewer protections for buyers, who are now responsible for addressing any previous liens or claims for the property.

- Lenders and title companies may refuse to help buyers secure financing or title insurance for a property sold under special warranty.

Special Warranty Deed FAQs

Special warranty deeds aren’t common for single-family home purchases, but if you do enter into one of these contracts, here are some additional things to know.

Why Would You Use A Special Warranty Deed?

Special warranty deeds protect sellers who don’t know the complete history of a home’s ownership and want to avoid any title complications that may arise. This is great for commercial real estate deals and inherited or foreclosed homes.

In these cases, sellers can only guarantee a title is clean from their period of ownership, and the deed places responsibility for any future claims on the buyer.

What Are Other Names For Special Warranty Deeds?

Special warranty deeds go by a number of other names, including covenant deed, grant deed and limited warranty deed.

What Are The Dangers Of A Special Warranty Deed?

Property debts are tied to the property’s title, so buyers agreeing to a special warranty deed assume all responsibility for any liens or claims against the property that may have existed prior to the seller’s ownership. Additionally, the risks of residential purchases with a special warranty deed can make it hard to secure financing or title insurance.

The Bottom Line

A special warranty deed is when the grantor only guarantees that there are no outstanding claims or liens against the property arising from their ownership. They’re not giving any assurances about issues that may come up due to the actions of previous owners. For that type of protection, you need a general warranty deed.

In cases when a general warranty deed isn’t in the cards, you can protect yourself by getting an owner’s title policy from a title insurance company. Special warranty deeds are most often used in estate transactions as well as those involving commercial properties and foreclosures.

When buying a home, it’s very important to understand what you’re getting when dealing with different types of deeds. We hope this has helped you understand the intricacies on a deeper level.

See What You Qualify For

You can get a real, customizable mortgage solution based on your unique financial situation.

Victoria Araj

Victoria Araj is a Staff Writer for Rocket Companies who has held roles in mortgage banking, public relations and more in her 15-plus years of experience. She has a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan.